Dropping Knowledge

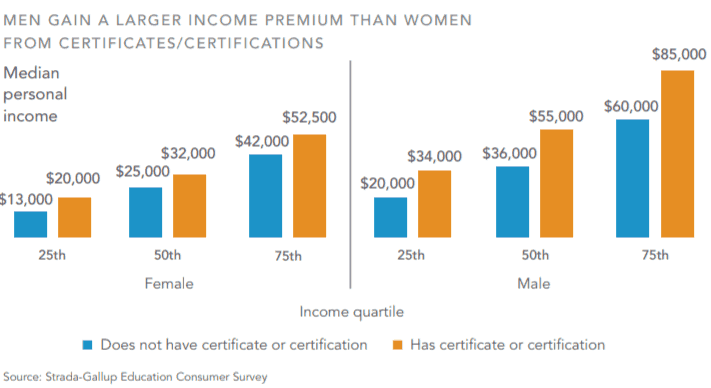

Strada Education Network, Gallup, and the Lumina Foundation teamed up to look at the impact of nondegree certificates and certifications on labor market outcomes for adults without a postsecondary degree. Based on a survey of 330,000 U.S. adults ages 18 to 65, the report finds that adults with a certificate or certification but no postsecondary degree report higher levels of employment and income than those with no certificate or certification. Specifically:

- 85% of adults with a certificate or certification but no degree report full-time employment compared to 78% of those without a certificate or certification.

- Those with a certificate or certification have a median annual income of $45,000 compared to $30,000 of those without a certificate or certification.

Additionally, the report points out that the wage premium for holding a certificate or certification can vary greatly depending on the occupation, and there are significant gender gaps. Across all occupations, men earn a higher wage premium for a certificate or certification than women.

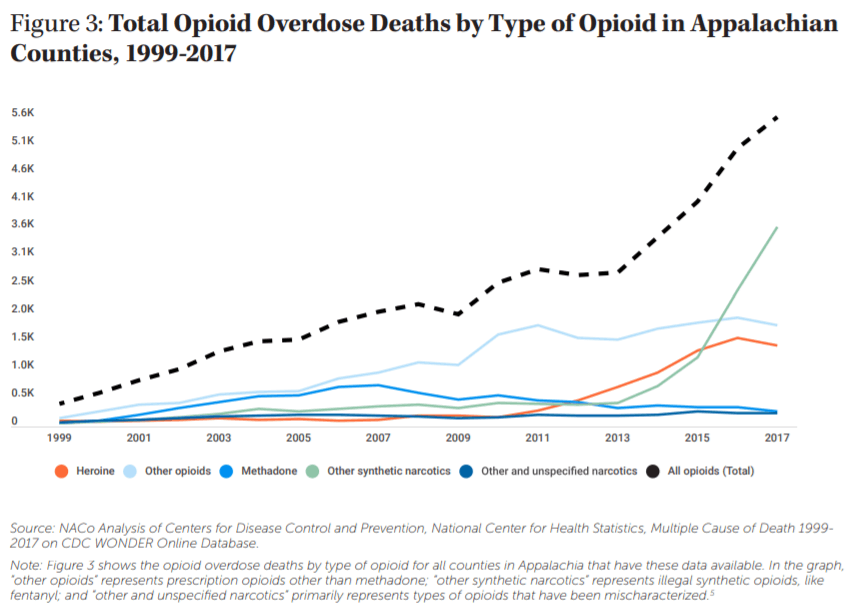

In the Weeds

Appalachian counties are on the front lines of dealing with the opioid crisis. According to a new report from the National Association of Counties and Appalachian Regional Commission, Appalachian counties have both higher opioid prescription rates and higher opioid overdose deaths than non-Appalachian counties. In recent years, overdose deaths from prescription painkillers have been replaced by deaths from synthetic opioids and heroin.

The report offers several recommendations for counties and includes case studies of successful initiatives. One case study focuses on Project Lazarus out of Wilkes County. According to the report, Project Lazarus is “a nonprofit organization established in 2007 that focuses on improving and coordinating community-based efforts to reduce prescription opioid overdoses.” The nonprofit offers training and technical assistance to stakeholders throughout the county, and its success has prompted replication in other North Carolina counties.

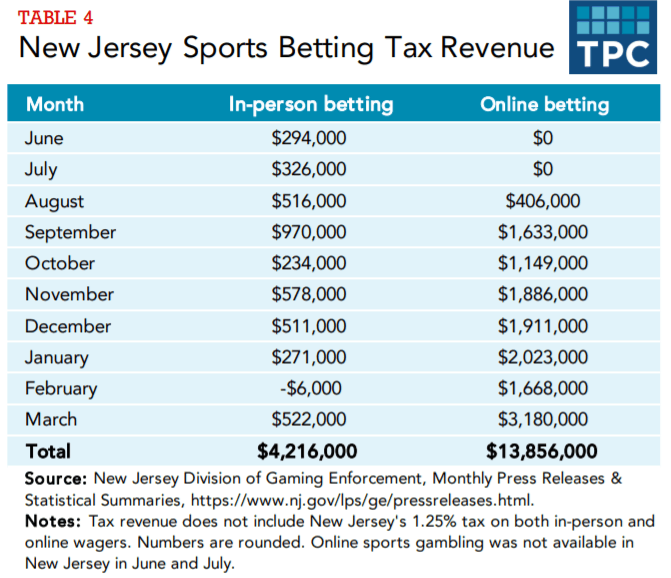

The Other 49

Since the U.S. Supreme Court ruling in 2018 that Congress cannot prohibit states from legalizing sports gambling, several states have moved towards legalizing sports gambling as a way to raise revenue. A new brief from the Tax Policy Center finds that in most states that have legalizaled sports gambling, the tax revenue generated is not as high as projected. Only two states, New Jersey and Nevada, had significant tax revenues of approximately $20 million in 2018.

Why these two states? The authors attribute the higher tax revenues in New Jersey and Nevada to the availability of online sports betting, which other states do not offer (or offer with heavy restrictions). In New Jersey, revenue from online betting has far exceeded revenue from in-person betting even though online betting hasn’t been available as long.

The brief concludes with three lessons for other states considering legalizing sports gambling:

The brief concludes with three lessons for other states considering legalizing sports gambling:

- States should be cautious with their tax rates on sports gambling

- Tax revenue from sports gambling will always be relatively small and volatile

- If states want to increase tax revenue from sports gambling, they should allow online wagers

What we're reading

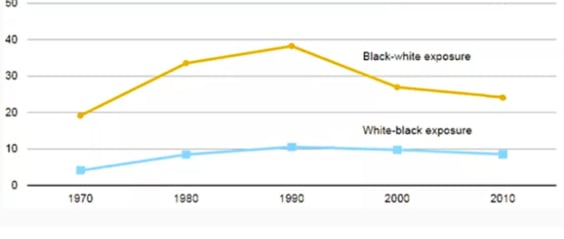

Brown v. Board at 65: Will Schools Ever Be Integrated?

The 74 Million takes a look at the legacy of Brown v. Board of Education on the 65th anniversary. ... Read the rest-

How to Attract Startups and Tech Companies to a City Without Relying on Tax Breaks

-

65 Years After 'Brown v. Board,' Where Are All the Black Educators?

-

As the Opioid Crisis Peaks, Meth and Cocaine Deaths Explode

-

100 students start 9th grade in NC. What happens next?

-

Sometimes politicians’ lofty promises of free college are too good to be true

-

Despite Missteps, High-Speed Rail Lines in 3 States Point to Progress